As fellow Floridians, we at VYRD, understand the frustration with the rising costs for Homeowners insurance personally. Floridians are paying the highest average premium in the US and yes, rates are expected to continue to increase. If you are coming up for renewal expect some sticker shock.

So, what’s happening … I know many feel “I haven’t had a claim, yet my rates keep going up” or “is my carrier just taking the money and running with more profits”. The reality is that that is far from the truth.

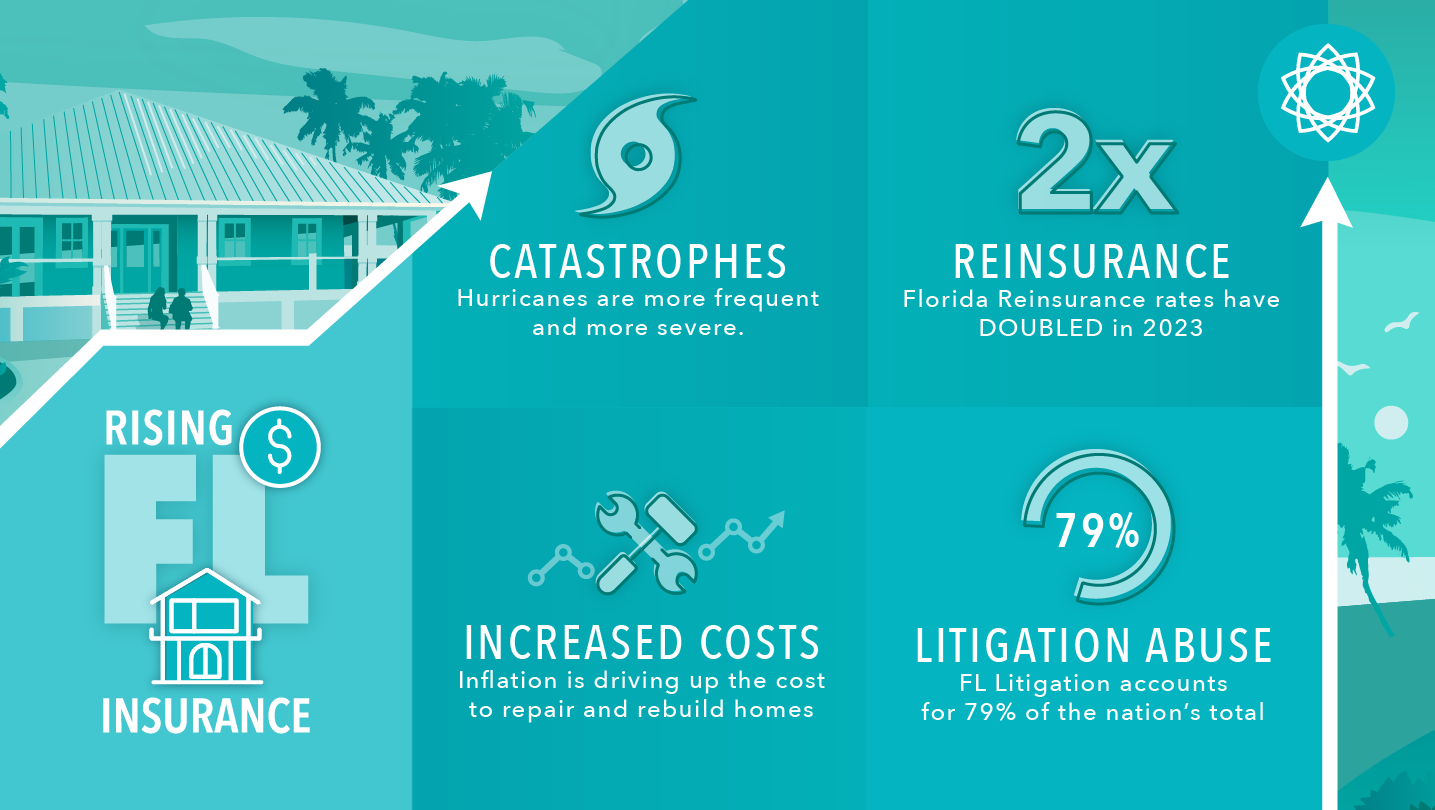

There are several factors contributing to these rising rates.

Let’s break it down:

- Increased number and severity of Natural Disaster – Florida’s location and low elevation makes it particularly susceptible to Hurricane damage and they are coming more frequently and creating more destruction. Home insurers have to model this into product pricing to cover the increased risk of potential claims.

- Limited Competition – National insurers have little presence here, leaving regional and local insurance like VYRD to provide coverage. And some of those have been forced into liquidation. This has resulted in a reduction in competition, leaving policyholders with fewer options.

- High Cost of Reinsurance – Because the market consists of small and medium sized insurers that operate exclusively in Florida, Reinsurance is a form of “shock absorber”, taking on some of the risk. With the increased incidents of CAT claims, Florida Reinsurance rates have doubled in 2023.

- Escalating Repair and Rebuilding Costs – Inflation is driving up the cost to repair and rebuild homes, both from increased labor costs to higher prices for materials. This has to be factored in carriers’ calculations, which directly impacts premiums.

- Litigation Abuse – Despite accounting for 9% of all homeowners’ claims in the US, Florida leads the country in insurance-related litigation, accounting for 79% of the nation’s total. The cost of fraud, legal abuse and outrageous legal fees amount to additional taxes included in the insurance premiums. According to the Florida Office of Insurance Regulation (OIR), between 2013 and 2020, Florida’s property insurers paid out $15 billion in claims costs. Only 8% of that was paid to consumers while 71% was paid to attorneys!

Florida homeowners’ insurance companies operate on a slim profit margin due to these growing expenses associated with claims, operating costs, and reinsurance. While insurance premiums may seem substantial, it’s important to understand that most of the money collected is reinvested back into the system to protect policyholders against potential losses.

Even Citizens, the state backed insurance carrier has confirmed that the premiums it charges are not sufficient to cover the risk it has assumed. If one or more major hurricanes hit South Florida’s Atlantic coast, it could quickly wipe out Citizen’s reserves and force it to impose emergency assistance to all Floridians across the state – even those who don’t have Citizens.

At VYRD, we strive to use sound actuarial pricing models that are approved by the Florida Office of Insurance Regulation. These models enable us to assess the risks we take on as accurately as possible and ensure that our pricing remains fair and competitive.

We want to help you find ways to mitigate the impact of these premium increases. We encourage you to reach out to your agent, who can work with you to explore all available options and take advantage of any applicable discounts we offer. Our discounts include options like the Claim Free, Secure Community, Preferred Contractor Endorsement, and Smart Home Water Protection discounts. Take a closer look at these ways to save. Your agent can guide you through the process and help tailor your coverage to meet your needs while taking advantage of these opportunities to save.