Claims

When should I notify VYRD after a loss or accident?

VYRD should be notified directly after a loss, so long as it is safe to do so.

Report your claim to VYRD online at VYRD.co by accessing your customer portal or by contacting us at 844-217-6993.

Even if you do not know the full extent of the damage, report your claim to VYRD as soon as you become aware of or suspect damage. A VYRD adjuster will contact you to discuss your loss and arrange an inspection of your property.

Please contact VYRD prior to contracting with anyone to make any repairs. There may be coverage limitations when not using our preferred contractor network.

How do I file a claim?

Be sure to set up your VYRD account online, and click the "FILE A CLAIM' button. We'll guide you through the process.

What information do I need to file a claim online?

What you will need:

- Your policy number

- Your contact information, including any temporary addresses or phone numbers where you can be reached if you have been displaced

- Damage description (example: tree fell on roof, lightning struck house)

- Mortgage company information (if applicable)

How can I help the claim process run smoothly?

To prevent further damage, you may need to make temporary repairs to your home. Before you make any repairs or remove any damaged contents from your home:

- Prepare a list of lost and damaged items using our Personal Property Inventory form.

- Keep any damaged items in a safe location so the specialist can complete an inspection of those items.

- Take photos to document the damage. Provide these photos to your assigned specialist to document your claim.

VYRD must inspect damages to determine reasonable repairs.

Prevent Further Damage

If safety and common sense allow, take steps to prevent further property damage by making temporary repairs wherever possible.

- It may be necessary to complete emergency repairs to prevent further damage. These may include turning off broken water supply lines, boarding up broken windows, placing a tarp on a damaged roof or having standing water removed from the home to start the drying process. Remember that your specialist must inspect your home and authorize any permanent tear out, removal or repair of items, before they are completed.

- Your assigned claim adjuster will estimate the damage to your home or business, but sometimes it may be necessary for experts, such as an engineer or specialized contractor, to inspect the damage with our specialist. You are also welcomed to obtain your own contractor's estimate and provide these to the adjuster for review.

Keep Your Receipts

- Request and copy original receipts for all purchases or services needed to make temporary emergency repairs.

- Save receipts for any additional living expenses you incur while your home is uninhabitable due to a covered loss.

- Save the copies for your personal records and give the original receipts to your adjuster. They will review the receipts and determine coverage for reimbursement under your policy.

What happens after I report a claim?

Your claim is assigned to an internal examiner who will review the details of the loss and verify the potential for coverage under your policy. They will then contact you for additional information and to review the claims process.

You will receive a claim number and contact information for your claims adjuster. Your VYRD adjuster will assign a specialist to schedule your inspection. If you have incurred damages due to the accidental discharge of water or steam, VYRD offers you the ability to connect with a network of vetted, licensed and insured local contractors who can make permanent repairs to your home for covered damages. Ask for more information about the Preferred Provider Program when you report a claim and find out if you are eligible to receive emergency water extraction and drying services.

Following the inspection, your claim will be reviewed by your assigned claims adjuster. If the loss is covered and the cost of the damage is more than your deductible, the examiner will submit your claim for payment. If the damage is not covered under your policy, VYRD will provide an explanation in writing. VYRD will answer any questions you have regarding your claim. You can review your policy and discuss your coverage with your agent at any time.

How does the claims process work?

- The claim is filed via VYRD’s contact center or online.

- An internal examiner reviews the information and makes first contact to review details of the damage and policy.

- An adjuster or preferred contractor will be assigned to perform an inspection of the damage and will develop a report and damage estimate for review by the examiner.

- The examiner decides whether coverage is eligible and reviews this information with you.

- The claim is settled and payment disbursed (less any applicable deductible) based on the conditions of the policy.

Note: If you have a mortgage company, we will be required to include them as a payee on any of the dwelling related payments. Contact your mortgagee to inquire on their process for obtaining an endorsement on a check.

How do I get the name, contact information, and status of my claim?

Upon report of your claim, you will receive a claim number and contact information for your VYRD claims adjuster.

Your claim information is also available by accessing your policy via the consumer portal at VYRD.co. You may also contact our claims department at 844-217-6993.

How long does an insurance claim take?

While we do work as quickly as possible to resolve your claim, the length of time is dependent upon the complexity of the loss.

The length of time it takes to resolve an insurance claim depends on several factors including the following:

- How long you wait to contact your insurance company. You should always file a claim as fast as possible after the loss.

- How quickly you provide all the documents to your claims adjuster. The longer your insurance adjuster must wait for key pieces of information to process your claim, the longer the process takes.

- The type of damage or loss. More straightforward property damage claims — like if a tree falls on your garage — are faster to process than more complicated liability claims that involve more people.

- How responsive you are to questions from your assigned claims adjuster. Again, the longer you take to respond to your adjuster, the longer the process will take.

- The total cost of the damage or loss. More expensive claims typically take longer to process than less expensive ones.

How is payment made?

Claim settlement payments are paid via paper check to the mailing address specified on the policy.

Why is the mortgage company listed on my claims check?

As a condition of their mortgage, your mortgage company has an insurable interest in your property. To protect their interest, we are required to include them as a payee on any payments relating to the dwelling structures.

For any additional questions, you may contact your mortgage company.

Will my premium go up?

Your individual policy will not be surcharged if your claim is the result of an Act of God (weather related), or if it is below the deductible or the payment is less than $500. Overall rate increases may or may not impact your future renewals. Rate increases are a reflection of the expected future losses of all policyholders combined, coverage changes, costs of reinsurance or statutory assessments. Concern for a policy surcharge should not be a consideration whether to report a claim. Reporting a claim timely is a requirement of the policy. Failure to do so may limit or your claim benefits.

How much will I have to pay, out-of-pocket?

Your out-of-pocket expense is dependent upon your deductible under the policy and or any special coverage limits included in your policy. Your policy deductibles are shown on your declarations page and within the consumer portal. Your claim representative can assist you with any specific questions surrounding coverage limits and applicable deductibles.

How do I get a contractor?

Your examiner at VYRD will assign a contractor based on our preferred contractor network to ensure your home is repaired with the utmost degree of attention and care.

What if additional damage is found after the initial estimate?

Supplements are commonplace in the insurance claims process after the initial payment is made. A Supplement is a claim for additional repair and/or replacement costs.

Contact your adjuster as soon as the supplemental damages are discovered. The adjuster will review all documents, damages, receipts, losses, etc. A re-inspection may be warranted to address the supplemental damages.

Additional payment(s) will be issued after the supplement is reviewed and approved.

What if I have an inquiry on an existing claim?

You can view your claims information via the consumer portal at VYRD.co or contact our claims department at 844-217-6993.

What is a Preferred Contractor Network?

It is a trusted group of contractors who have a proven reputation of reliability to mitigate, remediate, and repair your home. This network is designed to ensure your home is efficiently repaired with your best interest in mind, ensuring repairs will last to protect your home in the future.

When your home is damaged, you want relief fast so life can get back to normal. The Preferred Provider’s help customers with eligible policies get back on their feet by providing valuable emergency and permanent repair services following water loss not caused by weather. The program includes water removal and drying services for water losses not caused by weather and can connect you with local contractors who are licensed, insured, and agree to comply with VYRDs’ established service protocols for permanent repairs. Learn More

Product

What does a VYRD Homeowner's policy cover?

Your home is one of your most prized possessions, and you always want to feel that your family is secure and protected inside. Unfortunately, accidents or natural disasters can occur, resulting in expensive repair costs. You don’t want to cover those costs out of your own pocket. Your VYRD policy covers your home and property damage caused by things like wildfires, extreme weather, crime, and vandalism. It also protects you against legal claims for damage or injury you accidentally caused others.

Be sure to read your VYRD Homeowner policy carefully for complete descriptions and details.

The HO3 policy is available for detached, single family homes and duplexes in which at least one unit is owner occupied. The owner must live in the home as their primary residence. It covers the building, other structures on the property, the owner’s personal property, provides additional living expense and personal liability coverage.

The policy includes six distinct types of coverage:

- Dwelling coverage (Coverage A) - Covers the building and any attached structures. Depending on your policy and home type, the coverage amount is determined by either:

- Replacement cost - the cost of completely rebuilding the home and attached structures, following a total loss.

- Actual cash value (ACV) - the estimated cost of replacing your home with a similar home of the same year, condition and size, minus depreciation.

- Other structures (Coverage B) - Covers structures not physically attached to your home.

- Personal property protection (Coverage C) - Covers the depreciated value of your personal property and home contents - example clothing, appliances, and furniture.

- Loss of use (Coverage D) - Covers incurred additional living expense if you are temporarily unable to live in your home following a covered loss. These may include expenses for food, a place to live or other costs associated with maintaining your household.

- Personal liability protection (Coverage E) - Covers bodily injury or property damage for which you or other people covered by the policy are deemed legally liable.

- Medical payments (Coverage F) - Covers reasonable and necessary medical expenses if someone is injured on your property or, under certain circumstances, off the insured property.

Whats a "peril"?

A peril is an event, situation, or incident that causes property damage or loss. Fire, theft, wind, and vandalism are common perils that homeowner’s insurance can cover. The perils covered by your homeowner’s insurance policy are listed in your policy.

What is Actual Cash Value (ACV)?

It's an estimation of how much it will cost to replace or repair something damaged or stolen minus depreciation (the decrease in value over time)

What is Replacement Cost?

It is an estimation of how much it will cost to replace or repair something damaged or stolen with a similar item of the same quality, make and model. Replacement cost does not consider depreciation and usually does not include the cost of wear and tear.

What is a Declarations Page?

When you purchase a homeowner's insurance policy, when you renew your policy, or when you make changes to your policy, the company will give you a document called a "Declaration Page." The Declarations Page identifies the kinds and amounts of coverage you have and how much it will cost you. The Declaration Page is the first page of your homeowner’s insurance policy.

What is an Exclusion?

An Exclusion is a provision of an insurance policy referring to hazards, perils, circumstances, or property not covered by the policy.

What can I do to lower the cost of my Homeowner's Insurance premium?

The cost of your insurance (your premium) partly depends on the coverages, deductibles, and policy limits you choose. Here are few things to consider to help lower your premium:

- Talk to your Agent about your specific needs and eligibility for discounts

- Take advantage of our new Proactive Protection program

Does VYRD offer coverage for Smartphones?

VYRD is offering a new Smartphone Protection program via a limited-scale pilot through a partnership with bolt. This new product – bolt Protect provides coverage for your smartphone, including loss, theft, accidental damage, and malfunction. This pilot program is our first step in exploring this new product for our customer's on a wider scale. Please check back periodically to keep up to date on this offering.

How can I participate in the Smartphone Protection Pilot program?

Currently, the Smartphone Protection Program is available only on a very limited basis. Please contact us at Smartphone Device Protection | VYRD, select “I’m interested in Smart Phone Protection Coverage”, and we can work to see if you qualify for this exciting new offer.

If I'm a participant in the Smartphone Protection Pilot Program and need to file a claim, what should I do?

All you need to do is submit a claim within 30 days of the loss or occurrence of damage. Access our partners (bolt) website that manages the product offering - VYRD - Bolt - Device Protection for us. Click on the Start your claim button at the top and pay a deductible based on the value of your phone and whether it is repairable or needs replacement. In order to process your claim, you’ll need proof of ownership, the phone’s IMEI number and the date and details of the incident.

Smart Home Water Protection - FREE Sensors

How can I adjust or deactivate my humidity settings and alerts on my Phyn device?

Phyn provides a step-by-step guide to help you customize your humidity settings and alerts to your preferences. See it here.

What is VYRD's Smart Home Water Protection Program?

VYRD has partnered with Phyn to offer our policyholders an industry leading 24/7 home water protection and alert monitoring system for FREE! The Phyn Smart Water Sensing Kit valued at $250, includes 5 sensors that once placed at key sources of water monitors for leaks to help avoid costly damage. In addition, by participating in the program, policyholders receive a discount on their homeowners' insurance. Click here for more information.

Why did I receive a water sensor kit in the mail?

We’ve started sending water sensor kits to our customers based on their renewal date. If you activate your sensors, you’ll receive a 40% credit on your water premium—an average savings of $400.

Why are we sending you a kit? Because water leaks are one of the most common causes of home damage, accounting for nearly 50% of non-hurricane claims. This program is our way of helping you proactively prevent water damage before it becomes a costly issue.

What’s the catch? There isn’t one! This program is completely free—free sensors, free shipping, and free monitoring, with no hidden fees. Plus, as long as you keep your sensors active, you’ll continue to receive your discount at renewal—year after year.

We hope these sensors make it easy for you to protect your home and enjoy the savings!

How does the Smart Home Water Protection Program work?

The policyholders place the 5 sensors provided by VYRD in key water source areas of their home (eg. Toilets, AC Air Handler, Water Heaters) and receive notifications if a leak occurs.

- Sensors – Monitor for water leaks

- Phyn App – The app alerts the homeowner and allows them to manage their system from anywhere

- VYRD Monitoring – 24/7 monitoring that links to our claims specialists. VYRD will alert policyholders vis SMS text messaging ,inquiring if help is needed, and if necessary, facilitate opening a claim

How do I participate in the Program?

The Smart Home Water Protection Program is included just for being a VYRD policyholder. As a policyholder, just set up an account online at VYRD.co, and enroll and accept the VYRD Smart Home Water Participation Agreement. Be sure that you have Wi-Fi Access, then download the Phyn App and install the smart home kit.

Is there a policy discount for participating in the Smart Home Water Protection Program?

Yes! Policyholders will receive a 40% discount* (approximately $400) on a portion of their homeowner’s insurance premium once the sensors are activated. *The 40% discount applies to policies with effective dates on or after February 1, 2025. All other customers will receive a 15% discount (approximately $150) until their renewal, when they will be upgraded to 40%.

What happens if I don't install or activate the smart home kit?

After enrolling, the policyholder is expected to install and activate all 5 sensors included with the Phyn Smart Water Sensing Kit immediately in order to receive the premium credit.

When can I enroll in the program?

The VYRD Smart Home Water Protection Program is available for all policyholders of VYRD, and customers can enroll at any time.

Who is VYRD's approved vendor?

As of July 2023, Phyn is now VYRD's approved vendor, providing 5 Smart Water Sensors for our policyholders. The Phyn Smart Water Sensor alerts you audibly, visually and with SMS and app notifications the moment it comes in contact with water. You can also set custom alert thresholds for potentially damaging high and low humidity and temperature in the free Phyn app.

For our early adopters to the program that received and activated a Notion Smart Home Monitoring Kit, it will continue to be supported and policyholders will continue receive their premium discount.

How much does the Smart Home Kit cost?

VYRD provides the 5-sensor Phyn Smart Water Sensing Kit for FREE! That’s a value of approximately $200.

How do I install the sensors?

You can download this handy one-page guide to help you.

What do I need for the sensors to work properly?

You'll need the following for the Phyn Sensing Kit:

- Wi-Fi connection at 802.11 b/g/n at 2.4Ghz

- Phone with most recent iOS or Android OS

- SMS text messaging

- Phyn app

If I already have the Phyn water sensors in place in my home, how can I participate in this program?

Please contact the VYRD call center at 888-806-VYRD (8973) for the participation agreement form, that will need to be completed and returned to VYRD. The good news is you also will qualify for a discount on a portion of your premium!

Can I use other smart home devices to participate in this program or do they have to be Phyn Devices?

To participate in this program, the policyholder must have a Phyn Smart Water Sensing Kit in place. However, VYRD has arranged for a special Smart Home Water Protection discount to policyholders using other monitoring systems. Please reach out to your Agent for more details.

How do I learn more about the smart home devices before agreeing to participate in the VYRD Smart Home Water Protection Program ?

You can learn more about Phyn and their products at https://www.phyn.com/ as well as here.

What happens if the sensors go offline?

If the sensors go off line you run the risk of not being protected against leaks, but you will lose the premium credit.

Is VYRD still supporting the Notion's Smart Monitoring Starter Kit?

VYRD will be supporting your Notion Smart Monitoring Kit through October 15, 2024. If you have a Notion Kit, you must upgrade to the Phyn Sensing Kit by then to keep your water premium discount. You can apply for your free Phyn kit in the Customer Portal.

Why are you replacing the Notion devices?

Notion no longer supports the VYRD Smart Home Water Protection Program.

What do I do with Notion sensors after I’ve installed my Phyn sensors?

They can be discarded. They do not need to be returned to VYRD.

Smart Home Water Protection - Phyn Plus

What does the Smart Home Water Protection Plus Program include?

Our plus program includes a state-of-the-art shut-off device that connects to the plumbing system along with water sensors that can be strategically placed in key areas of your home

How does the shut-off device, the Phyn Plus work?

The shut-off device is called a Phyn Plus and is designed to respond to signals from the water sensors or to information it collects on its own. When a issue is detected, such as a leak or excess moisture, the Phyn Plus will alert you via the Phyn app and can also automatically turn off the water supply, minimizing potential damage.

Can I customize the areas covered by the water sensors?

Yes, the placement of water sensors is customizable based on your home's specific needs. We highly recommend the following areas that are most prone to potential water damage:

- Air handlers

- Water heaters

- Washing machines

- Toilets

- Sinks

- Refrigerators

- Dishwashers

Will the shut-off device work during a power outage?

Yes, the Phyn Plus is equipped with a battery backup to ensure functionality during power outages. Rest assured that your home remains protected even in adverse conditions.

How do I receive alerts about water issues in my home?

Real-time alerts through Phyn’s user-friendly mobile app. You'll receive notifications on your smartphone, allowing you to take immediate action or assess the situation remotely.

Is professional installation required, and is it included in the program?

Yes, professional installation is included as part of the program. Certified technicians will ensure that the shut-off device is installed correctly and tailored to your home's layout.

Can I monitor the system and check its status remotely?

Absolutely. The Phyn mobile app allows you to monitor the system in real-time, check the status of sensors, and receive updates on any detected issues, providing you with peace of mind wherever you are.

How much does the Smart Home Water Protection Program cost?

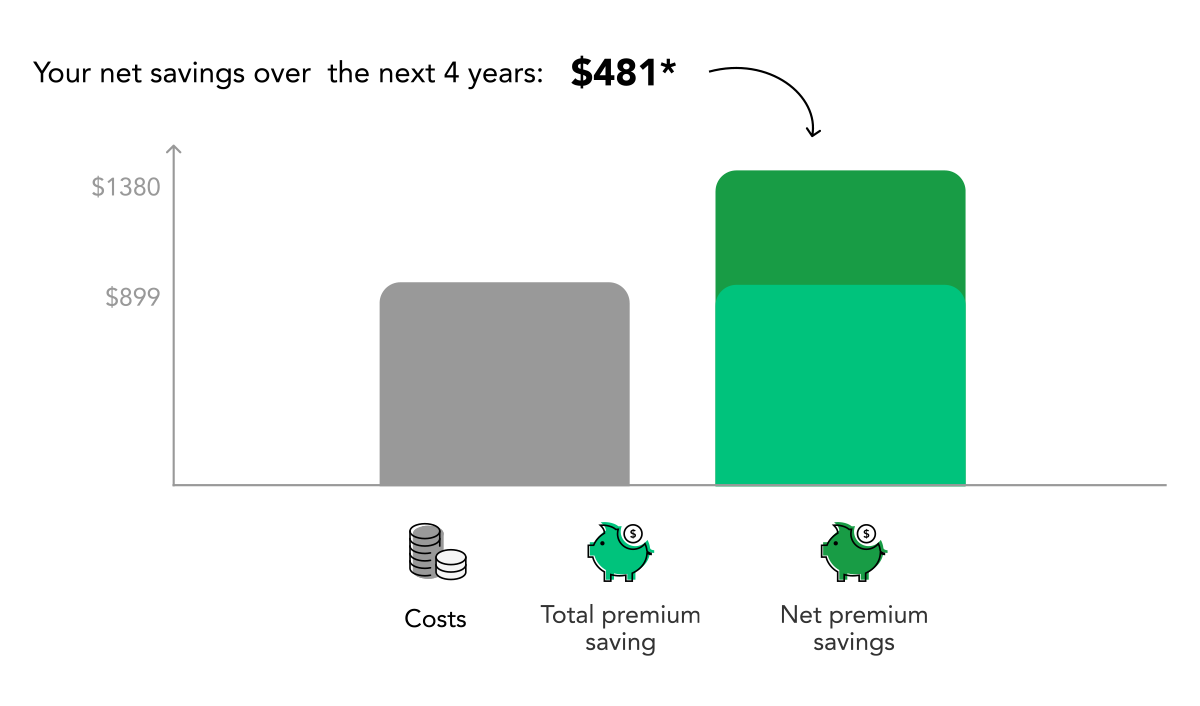

The enhanced Plus Package offers the Phyn Plus water shutoff device with professional installation at a discount for $899 ($1060 value). VYRD offers a 50% water premium discount (up to $345 a year) giving Plus enrollees a return on investment over time (see chart below). VYRD also offers the Smart Home Water Protection Standard Package that’s entirely free. Learn more about the FREE Water Sensor Program.

Will enrolling in the Smart Home Water Protection Program result in a premium discount on my homeowners insurance?

Yes, we offer premium discounts for customers enrolled in the program. You can receive up to $345 off your premium annually taking advantage of the Plus program, that offers a more comprehensive monitoring plan. If you decide to take advantage of our free sensors, your savings will run on average $148*.

If I decide to leave the program, will it affect my premium savings?

Yes, if you leave the program, your savings will be impacted. The premium discount is applicable as long as you stay enrolled.

What happens if I cancel my policy?

You own these devices. If your policy terminates for any reason, the sensors and the shutoff device are yours.

How is the data from the water sensors managed, and who has access to it?

The data from the water sensors is treated with the utmost privacy and security. As your insurer, we have access to this data to ensure the effectiveness and enrollment of the program and provide you with the best possible service. Rest assured, we adhere to strict privacy policies, and your data will not be shared with any unauthorized third parties.

Will the data from the water sensors be used to adjust my insurance rates?

Only to the extent that it confirms compliance with the program and eligibility for the associated discounts. The primary goal is to enhance the effectiveness of the Smart Home Water Protection Program and mitigate potential water damage to your property.

How long is the water sensor data retained, and can I access it?

The water sensor data is retained for a limited time to ensure the proper functioning of the program. While you may not have direct access to the raw data, you will receive real-time alerts and updates through the Phyn mobile app, keeping you informed about the status of your home and any detected issues.

Identity Theft Expense and Resolution Services Coverage

Who is covered?

The following people are covered: the policyholder, spouse, domestic partner, children living at home, up to age 21 or full time student up to age 26, and grandparents living at home.

Who is not covered?

Anyone who does not meet the criteria of people that are covered.

How do I file a claim?

Please call our Claims team at 844-217-6993 to report an identity theft event and they will connect you with the Identity Response Center team to assist you with restoring your identity.

Who is PrivacyMaxx and what is the relationship between your insurance company and the PrivacyMaxx Identity Response Center?

PrivacyMaxx is an identity theft and privacy protection company that provides identity theft monitoring and recovery services to consumers. They are a third-party vendor who we contracted with to provide you with this valuable assistance if you are a victim of identity theft.

What services does PrivacyMaxx provide?

PrivacyMaxx will be providing identity theft monitoring solutions and resolution services to help guide victims along the path to clearing their name after becoming a victim to identity theft. Their Identity Response Center provides 24/7 access to report identity theft issues and get assigned to a dedicated victim recovery advocate who will work with you to restore your identity after a covered event.

Do I need to provide you with a list of my family member’s names?

No, we do not need a list of names.

What is a covered identity theft event?

"Identity Theft" means the act of knowingly transferring or using, without lawful authority, a means of identification of an insured with the intent to commit, or to aid or abet, any unlawful activity that constitutes a violation of federal law or a felony under any applicable state or local law.

What, if any, exclusions exist?

The following are not covered:

- Loss arising out of business pursuits of any insured.

- Expenses incurred due to any fraudulent, dishonest or criminal act by an insured or any person acting in concert with an insured, or by any authorized representative of an insured, whether acting alone or in collusion with others.

Customer Portal

How do I register and create an online account on VYRD.co?

You can access your online account by registering here. All you'll need is the email you provided your Agent when they set up your policy. If you are unsure, just use your policy number.

How do I reset my password?

It happens, but don't worry — you can easily reset your password. From the welcome/login page, just click the "FORGOT PASSWORD?" link and enter the email address you used to register with VYRD. We'll send you a password reset link.

What can I do once I set up my account online?

By setting up your account, you can view your policy, file a claim, view documents and pay your bill. So be sure to register!

How do I make a payment?

Just set up your account on VYRD.co, and make your premium payments online. VYRD accepts payments from US checking and savings accounts as well as debit and credit cards. We can only accept one-time payments at this time. And you can also pay over the phone by calling us at 888-806-VYRD(8973).